Better Position ORO for Future Growth

In response to evolving marketing trends, ORO has announced a strategy shift to focus on serving business customers.

Designed for corporate clients, ORO makes international transfers fast, secure, and effortless.

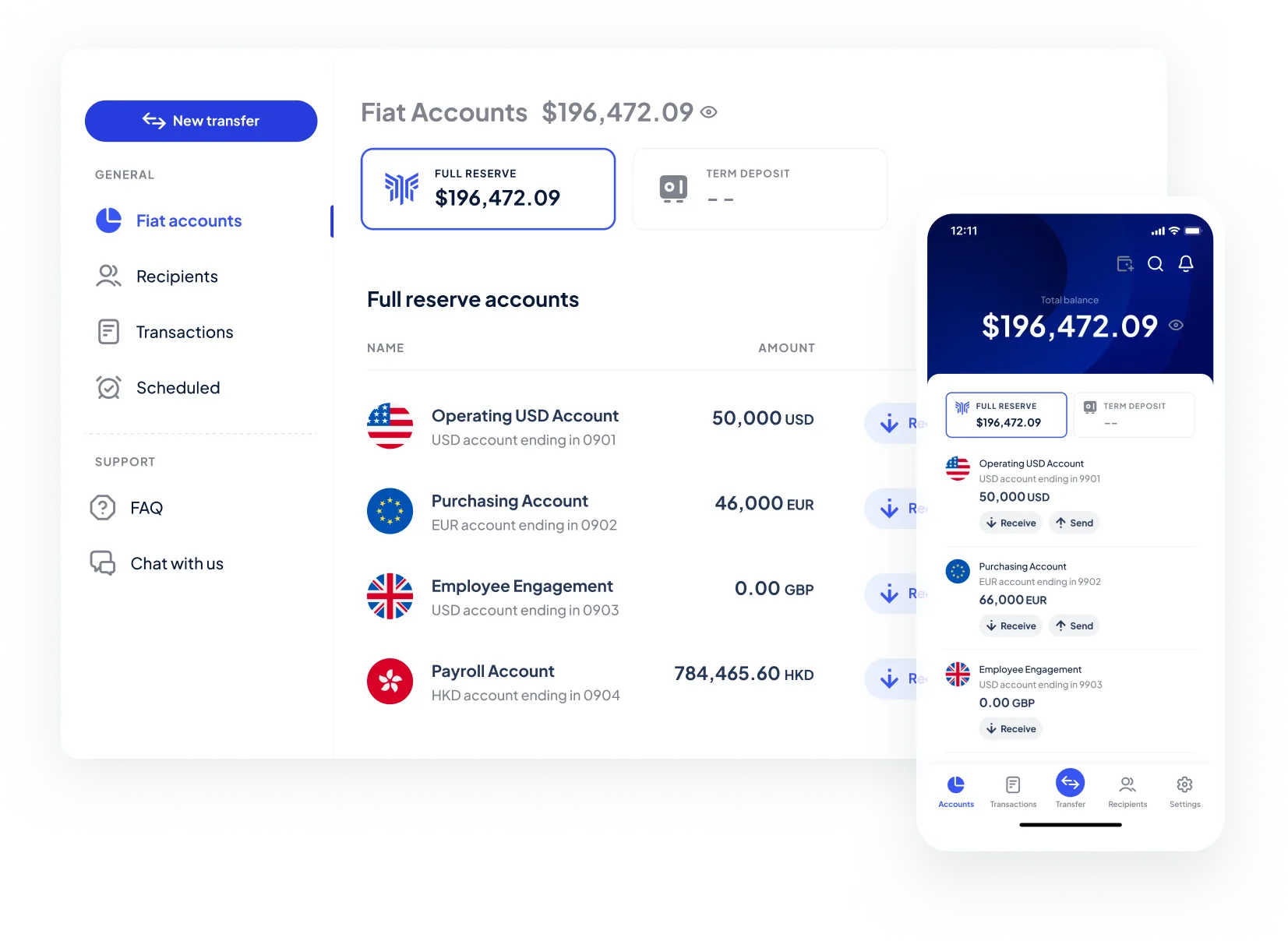

Open and manage multi-currency accounts including USD, EUR, GBP, HKD, AUD, and more. All in one place.

Sign up and get started today.

Get started

Being a small nation makes us a smart nation, this is not out of choice but out of necessity. Technology is an indispensable tool that will be necessary to realize this aspiration

Jigme Khesar Namgyel Wangchuck

At the moment, ORO registration is not available for Bhutanese citizens residing in Bhutan. We recommend exploring Digital Kidu, a Bhutanese bank where you can easily open an account. We appreciate your understanding.

7 currencies supported

USD, EUR, GBP, SGD, HKD, JPY, and AUD

More currencies are coming 🚀

*Approval time may vary*

Screen customers against 1000+ global watchlists and 100+ sanctions lists, incl. OFAC, UN, HMT, EU, DFAT, etc

Identify PEPs by checking 7,000+ sources and providing their profiles, including information on family members and close associates

Monitor thousands of media sources for negative mentions and aggregate the data into customer profiles on an ongoing basis

Harness the power of AI and industry expertise to detect AML/CFT risk and stay compliant with our cutting-edge transaction monitoring solution.

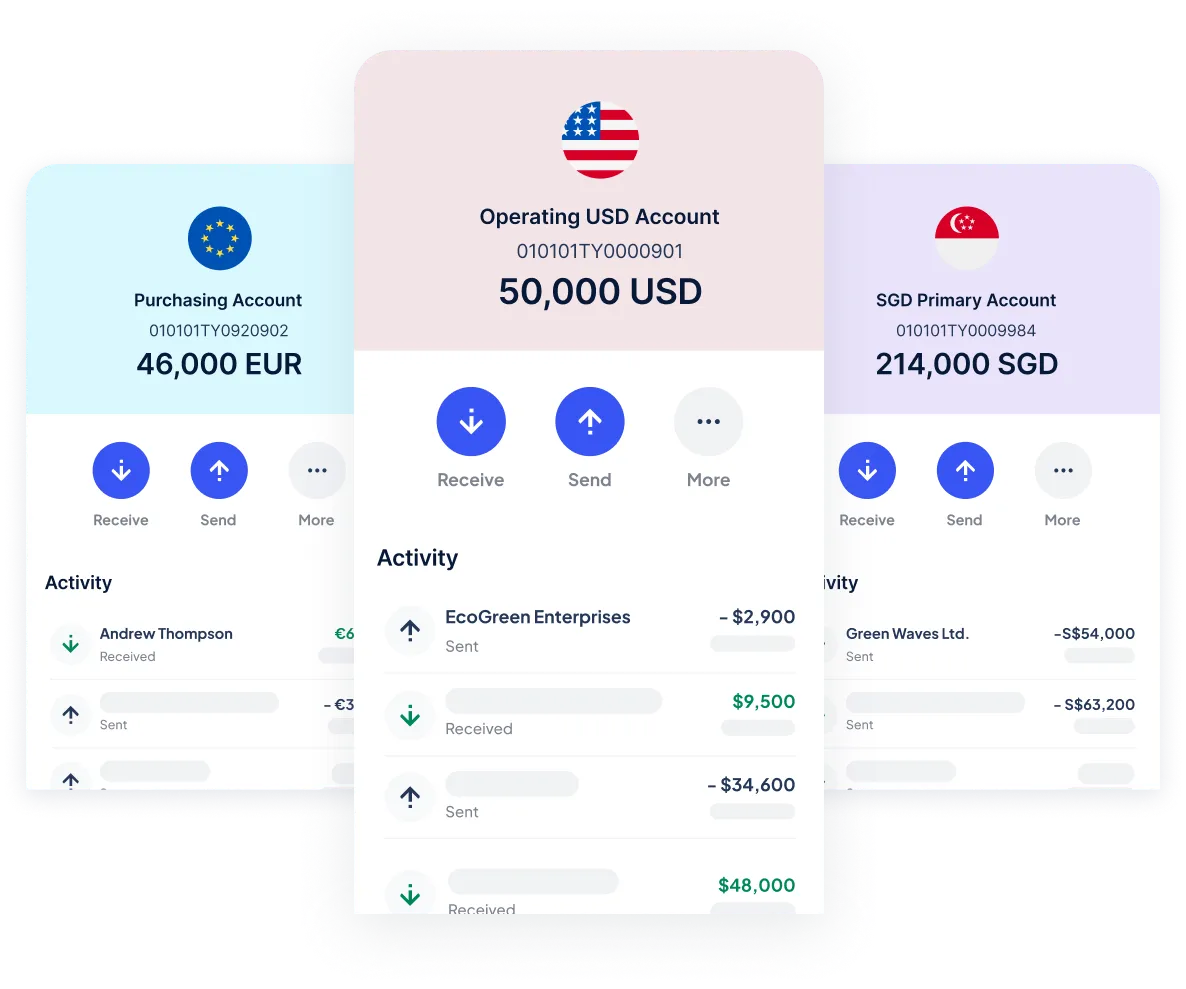

Instant O-Net transactions and rapid international transfers, all with efficient settlements, ensuring your funds ready at all time.

Your deposits are always 100% available and never used for lending or investments. This is core to our business proposition, values, and our unwavering commitment to customers and the standard by which we are regulated.

Our compliance with global guidelines ensures that your money is always handled responsibly and securely, no matter where in the world it goes.

Create and transfer between different currency accounts without the hassle of conversion.

In response to evolving marketing trends, ORO has announced a strategy shift to focus on serving business customers.

We are pleased to announce a special one-time credit of $30 for each customer who purchases the Gelephu International Airport Fixed-Term Deposit (FTD) programme. This credit is a token of our appreciation to reward your commitment and help offset the international transfer fees you may have incurred while investing in the FTD.

Thimphu, Bhutan, November 11, 2024 — The Gelephu Investment and Development Corporation (GIDC), established by Royal Charter as Gelephu’s sovereign development body, has partnered with ORO Division – DK Bank, to introduce a nation building campaign for the international airport at Gelephu Mindfulness City (GMC).

ORO welcomes everyone. Our inclusive approach extends to all individuals and entities, including those typically not served by traditional banks, such as startups, fintech companies, and other businesses. If you fit the following, ORO is for you!!

At present, ORO supports transfers in 7 currencies: USD 🇺🇸, EUR 🇪🇺, GBP 🇬🇧, SGD 🇸🇬, HKD 🇭🇰, JPY 🇯🇵, and AUD 🇦🇺.

Bhutan, nestled in the Himalayas, is a serene kingdom renowned for its breathtaking landscapes, vibrant cultural heritage, and commitment to Gross National Happiness. Bhutan’s vision and leadership assure political independence and stability, with a strong focus on sustainability and wellness that aligns perfectly with ORO’s mission. The creation of a Special Administrative Region demonstrates Bhutan’s commitment to innovation, making it an ideal location for ORO and its customers.

ORO is the national bird of Bhutan and symbolizes divine guidance and protection for the country. Additionally, ORO means gold in Spanish. This dual symbolism emphasizes our commitment to intelligence, guardianship, and the enduring value we strive to provide our customers.

Experience the power of sustainable banking